2020 unemployment insurance tax refund

The total unemployment compensation was 10201 or more. 6 hours agoUnder the new legislation employers who paid their tax bills before the April 30 due date would get a refund.

Unemployment Benefits Tax Free Do You Need To Amend Your 2020 Tax Return Youtube

The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income.

. On Nov 1 the IRS announced that it had issued approximately 430000 tax refunds to taxpayers who overpaid taxes on their unemployment benefits in 2020. Visit Unemployment and 2020 tax returns for more information. The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits.

You will exclude up to 20400 from your federal AGI. 18 which incorporates recent federal tax changes into Ohio law effective immediately. Heres a summary of what those refunds are about.

The 19 trillion coronavirus stimulus plan that President Biden. The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. The American Rescue Plan Act of 2021 excludes a certain amount of unemployment from your federal AGI for your 2020 tax year based on your filing status.

The Internal Revenue Service has sent 430000 refunds totaling more than 510 million to people who overpaid on taxes related to their unemployment benefits in 2020. If you received unemployment benefits in the 2020 tax year due to job loss from the pandemic you could be eligible for a tax refund of up to 10200. What are the unemployment tax refunds.

If you filed your taxes after the ARPA was established you should automatically get that refund on your tax return. You should not have to create a mock amended return or make any changes in TurboTax. Montpelier Vt The Vermont Department of Taxes has begun issuing refunds to eligible taxpayers who received unemployment insurance benefits last year and electronically filed their 2020 Vermont Individual Income Tax Returns prior to the federal unemployment tax exclusion passed earlier this year.

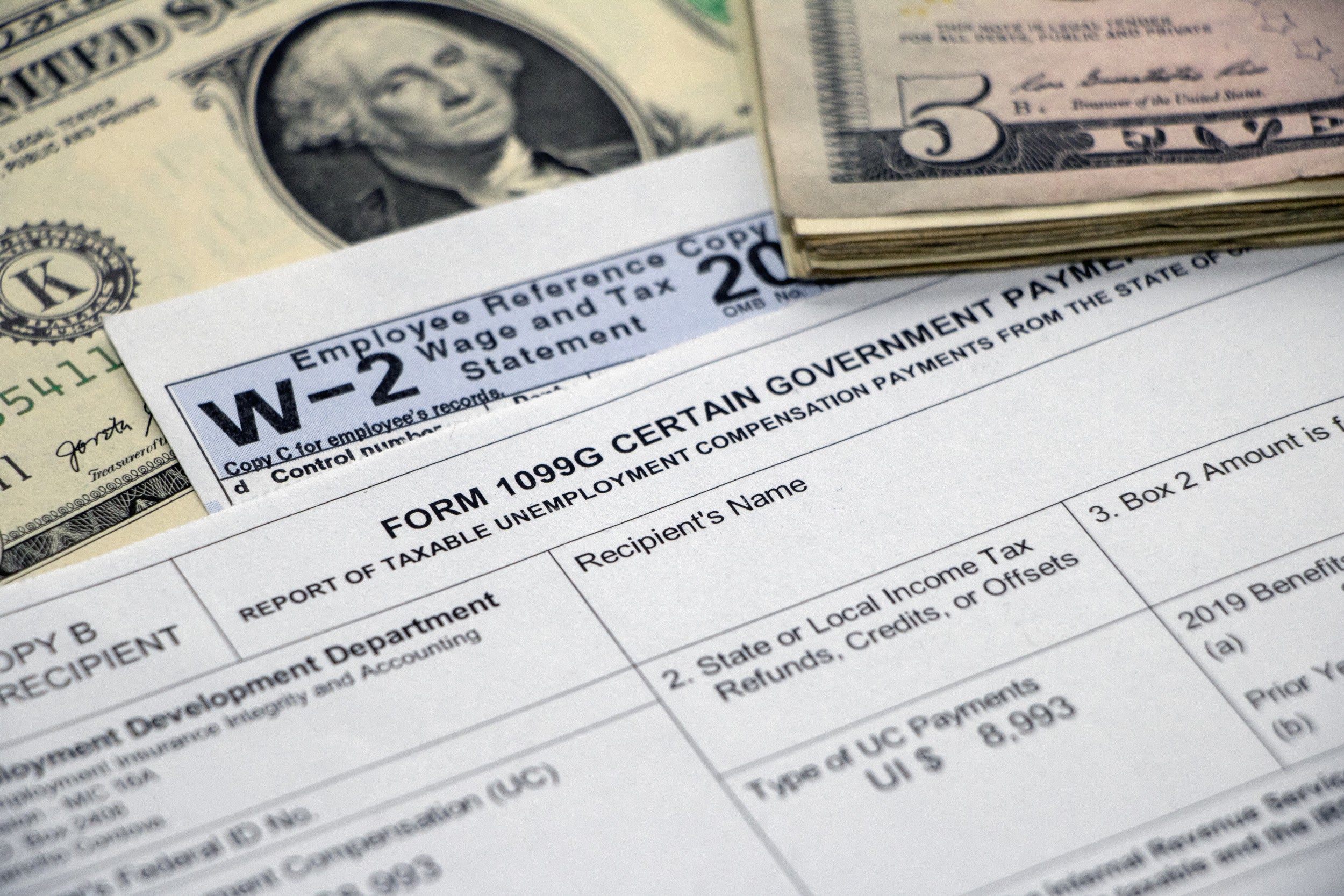

On March 31 2021 Governor DeWine signed into law Sub. To date the IRS has issued over 117 million refunds totaling 144billion. If you received unemployment you should receive Form 1099-G showing the amount you were paid.

Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. This article will be replaced if Wisconsin law changes. If you claim unemployment and qualify for the adjustment you don.

The first 10200 of 2020 jobless benefits 20400 for married couples filing jointly was made nontaxable income by the American Rescue Plan in. The IRS is now concentrating on more complex returns continuing this process into 2022. If the IRS has your banking information on file youll receive your refund via direct deposit.

House Democrats also included the full 27 billion that Senate Republicans and Walz. In some cases when Form 1099-G Certain Government Payments information was not available the IRS automatically allowed an exclusion amount of up to 20400 for married individuals who live in a non-community property state and who filed a joint 2020 tax return when. 2020 tax return only.

Americans who collected unemployment benefits last year could soon receive a tax refund from the IRS on up to 10200 in aid. Taxpayers should not have been taxed on up to 10200 of the unemployment compensation. This is not the amount of the refund taxpayers will receive.

Overall the IRS says unprocessed individual tax year 2020 returns included those with errors. Your CDDownload software should reflect this as if the exclusion was in place when you filed. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person.

1 the IRS announced it had sent about 430000 tax refunds to taxpayers who overpaid taxes on their unemployment in 2020. The federal American Rescue Plan Act of 2021 Public Law 117-2 signed into law on March 11 2021 allows an exclusion of up to 10200 of unemployment compensation UC on the 2020 federal income tax returnThis federal law does not apply for Wisconsin tax purposes. Changes in how Unemployment Benefits are taxed for Tax Year 2020.

For folks still waiting on the Internal Revenue Service. Specifically federal tax changes related. Billion for tax year 2020.

But 13 days later the deposits still have not. People who received unemployment benefits last year and filed tax returns on that money could receive the extra funds the IRS said in a press release. Ohio Income Tax Update.

Married filing jointlyregistered domestic partners. You do not need to take any action if you file for unemployment and qualify for the adjustment. Check For the Latest Updates and Resources Throughout The Tax Season.

President Joe Biden signed the pandemic relief law in March. A portion of your unemployment payment does not count toward your adjust gross income AGI. As Americans file their tax returns for 2020 -- a year riddled with job insecurity -- millions who relied on unemployment insurance during the.

TurboTax updated its 2020 software last March to add the exclusion for the first 10200 of unemployment benefits for households making less than 150000. On May 14 the IRS announced that tax refunds on 2020 unemployment benefits would begin to be deposited into taxpayer bank accounts within the week. How to report Federal return.

You will exclude up to 10200 from your federal AGI. The IRS has issued more than 117 million special unemployment benefit tax refunds totaling 144.

Irs Unemployment Refunds What You Need To Know

Irsnews On Twitter Irs Is Issuing Refunds For Taxes On 2020 Unemployment Compensation That Were Paid Before They Were Excluded From Taxable Income By Recent Law Changes Details At Https T Co Hcqbfq5oze Https T Co Tt4lhu7uff

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Felder Demands Tax Relief Again Ny State Senate

How To Get A Refund For Taxes On Unemployment Benefits Solid State

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

How To Claim Unemployment Benefits H R Block

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

Unemployment Tax Refund How To Calculate How Much Will Be Returned As Com

Unemployment Income And Why You May Want To Amend Your 2020 Tax Return